Irs Imputed Income Table 2025

BlogIrs Imputed Income Table 2025. Irs tax rules for imputed interest. Step by step irs provides tax inflation adjustments for tax year 2025 full 2025 tax tables publication 17 (2025), your federal income tax

The imputed interest is the difference between the afr and the interest rate actually charged by the lender. Irs tax rules for imputed interest.

Life Insurance Tax Free Financial Report, The top 1 percent of taxpayers paid a 25.9 percent average rate, nearly eight times higher than the 3.3. In 2025 and 2025, there are seven federal income tax rates and brackets:

Irs Uniform Lifetime Table 2025 a2022h, See the tax rates for the 2025 tax year. Under the 2025 tax code, imputed interest is generally considered to be taxable income.

Simulador De Taxes 2025 Irs IMAGESEE, In october, the internal revenue service (irs) announced new brackets. The change will raise the top tax rate of 37% to $609,350 for individuals and $731,200 for married couples filing jointly—up from the current tax season’s threshold of $578,126.

2025 Tax Rates TAX, As an example, let’s consider the following loan: The gift tax exclusion for 2025 increased to $18,000 from.

Tabelas Anuais De Irs 2025 Withholding Certificate 8288 Instructions, Under the 2025 tax code, imputed interest is generally considered to be taxable income. The imputed interest is the difference between the afr and the interest rate actually charged by the lender.

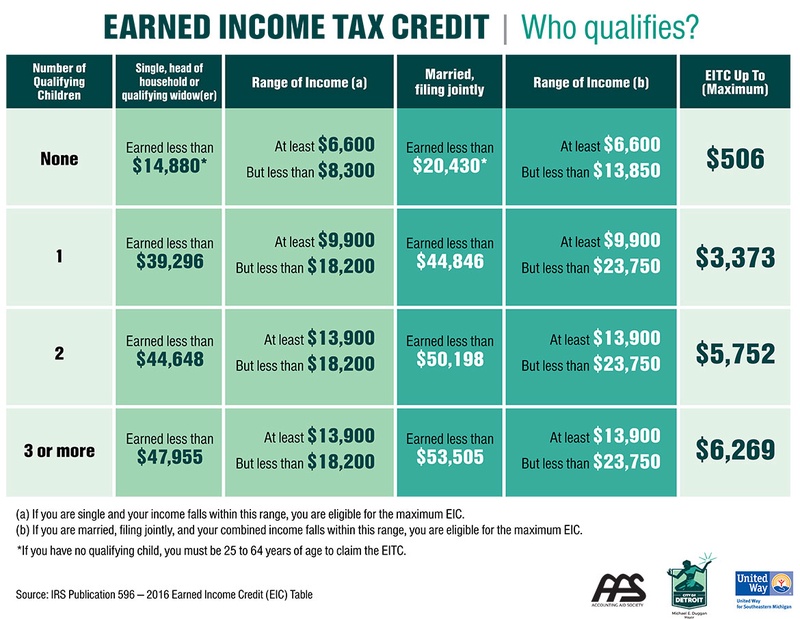

The Ultimate Guide to Help You Calculate the Earned Credit EIC, If you saw a significant change in income over the past year, you may find yourself in a new tax bracket. Enter the result here and on the entry space on line 16.

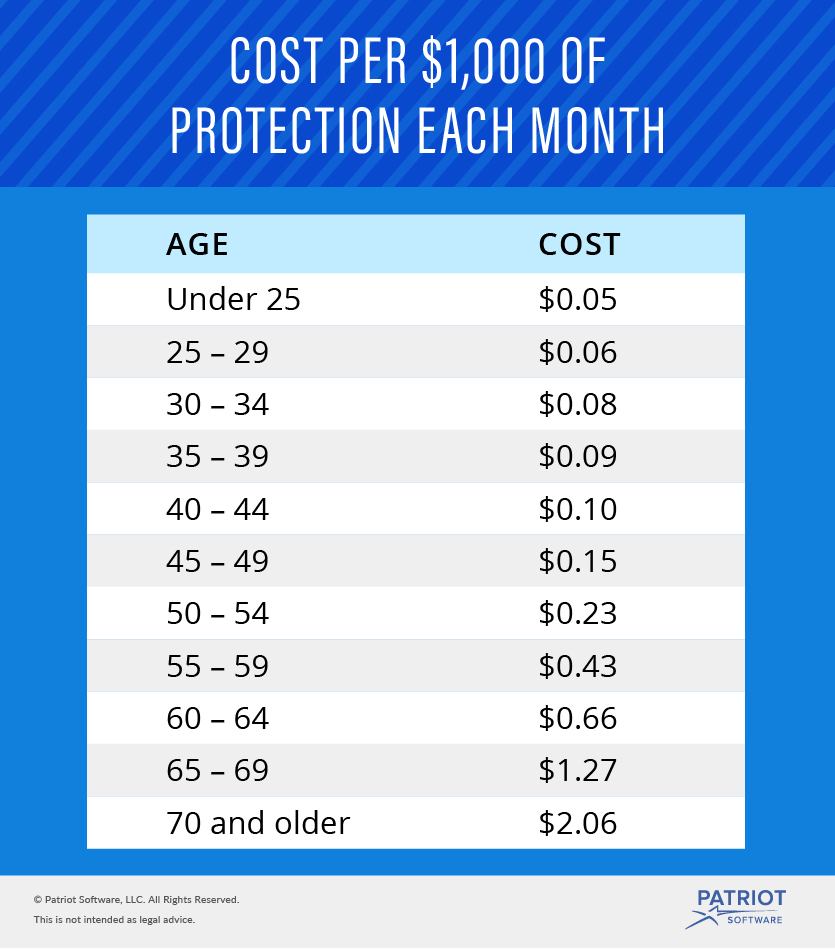

GroupTerm Life Imputed, In october, the internal revenue service (irs) announced new brackets. If all your heirs are named as beneficiaries of a trust, you.

Irs Withholding Rates 2025 Federal Withholding Tables 2025, If you had 20 heirs you could gift $360,000/year. The irs has released ( rev.

Tax Table 2017 18 Monthly Review Home Decor, In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

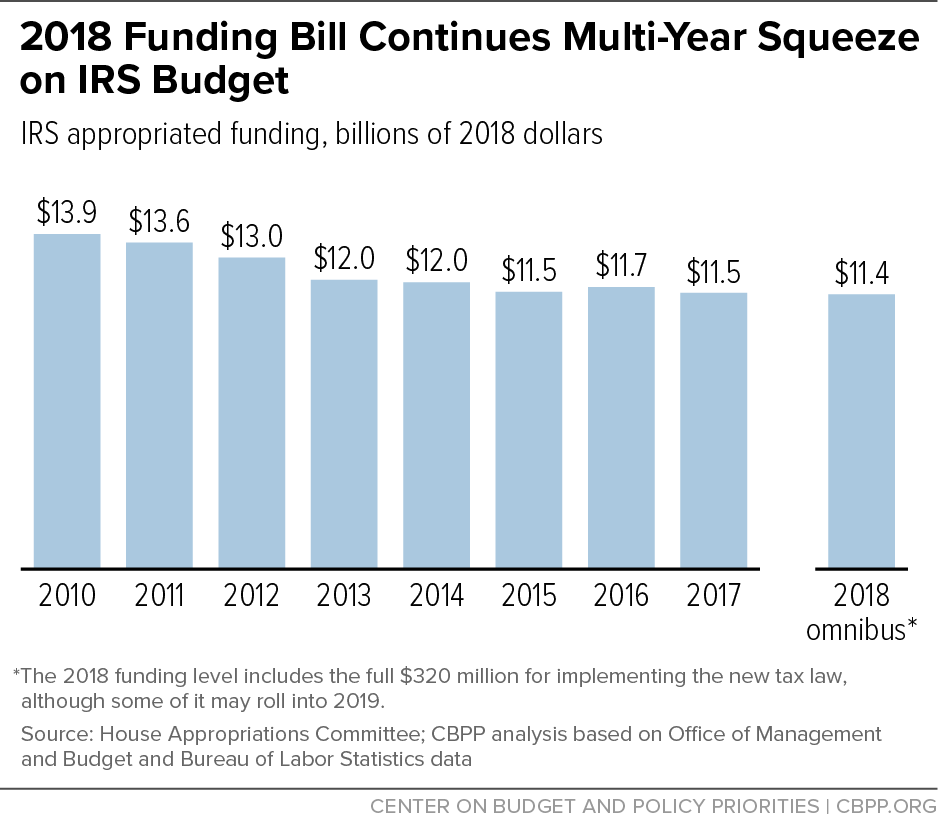

Progressive Charlestown Fewer staff mean more tax cheating, $ × 24% (0.24) $ 6,600.00. Enter the result here and on the entry space on line 16.

Gifting can help reduce the value of your estate without using up your lifetime gift and estate tax exemption.